Indiana’s HB 1432: Online Casino Bill Clears First Hurdle

Indiana bill HB 1432 cleared its first hurdle in the Indiana Legislature in the start of 2025.

Indiana joins other states in introducing new iGaming legislation. © Clker-Free-Vector-Images, Pixabay

Key Facts:

- The Bill passed in the House Public Police committee on the way to a full House vote.

- HB 1432 would allow each Indiana Casino up to three skins at a tax rate of 26%.

- Lawmakers quickly added a raft of amendments.

The Indiana iGaming bill was quick out of the gate, racing through the Indiana House Committee on Public Policy and on to the full House with only a slightly delayed three-hour discussion and a handful of added amendments to weigh it down.

It passed 9-2. It joins roughly a dozen other states like New York, Illinois, and Wyoming in discussing joining the seven states where iGaming is already legal.

Each of the state’s twelve casinos and one tribal casino would be allowed to apply for a license and operate up to three skins. For now, the tax rate would be 26% for the first couple of years and then become tiered based on GGR.

It would also fund the Indiana Responsible Gambling and Problem Gambling Services Program, which we hope is just a placeholder for a shorter, catchier name.

In any case, the bill would funnel at least $3 million to the program and ask operators to pay for other ancillary Responsible and Problem Gaming programs.

If passed, it also has a rather ambitious starting date of September, though there are several hurdles, not the least of which is pushback from PENN National and Churchill Downs, both of which operate casinos in the Hoosier state.

PENN lobbyist John Hammond was bold enough to tie his opposition to the bill to another bill, HB 1433, which also passed through the committee this week. This bill allows electronic pull tabs in taverns, VFWs, and American Legions.

Charities have long been allowed to run paper pull tabs in the state, but according to Hammond, the introduction of electronic pull tabs at the state’s 730 American Legions is a “live grenade” threatening the cannibalization of the casinos’ revenue.

It is perhaps a poor choice of words when many of the people the Legion helps have faced actual live grenades.

Amendments Added to Indiana HB1432

Never ones to pass up marking up a good bill, Indiana legislators were quick to add amendments, many only remotely tied to iGaming. One calls for special training for alcohol servers working in any place that offers gambling.

Another would pull the Indiana casino license of any company deemed to be operating in illegal markets. One might have thought that would have been discussed before the license was issued, but perhaps it’s better to be safe than sorry.

Another amendment would raise the tax on already legal mobile sports betting to 20% from its very reasonable 9.5%. In all fairness, Indiana currently has the fourth lowest tax on sports betting, behind Iowa and Nevada, which levy 6.75%, and Michigan, which taxes sports betting at 8.4%. The amendment would leave 9.5% of sports books at retail and only apply to mobile betting.

The most strategic of the Amendments, calling for including the states’ only tribal casinos in the iGaming licensing process, though begs the question of why they weren’t included in the original bill. Solidifying the support of the Pokagan Tribal Gaming authority removes one more powerful lobbying group that had been opposed.

The iGaming and electronic pull-tab bills could be voted on by next week. Still, it is also possible that the Indiana House waits til closer to the end of the session before tackling such contentious issues. A study commissioned by the legislature in 2023 estimated as much as $2 billion in revenue in the first three years.

A 26% tax rate would generate about $780 million in new tax revenue over that time frame, which would be more than enough to cover the state’s 130 million dollar deficit in 2024.

However, it remains to be seen whether legislators will overlook the strong opposition of some of the state’s land-based casino operators to anything that might upset their already profitable apple cart.

Three New Champions Crowned During Poker’s Busy December

Three New Champions Crowned During Poker’s Busy December

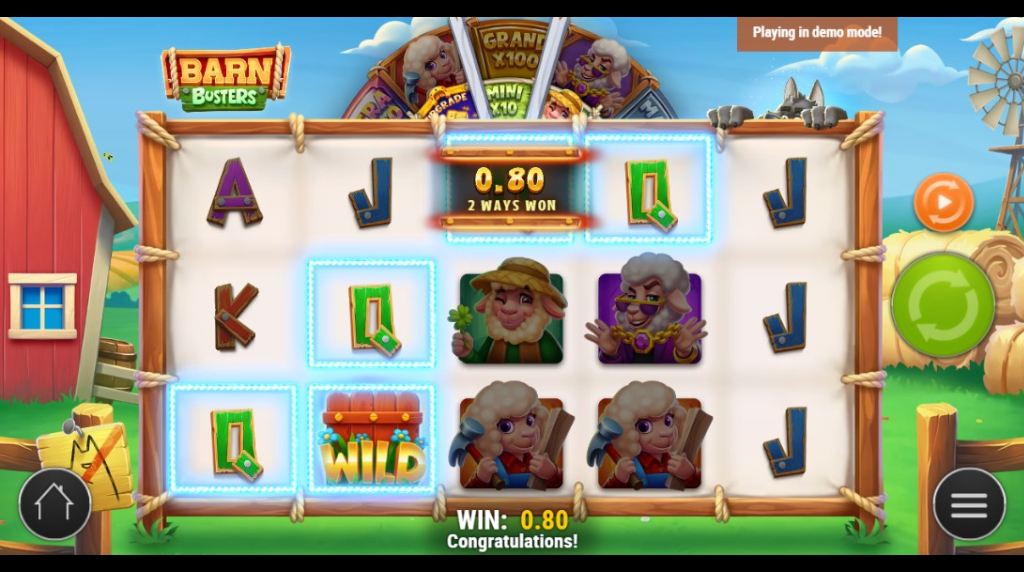

Barn Busters Slot Preview by Play’n GO

Barn Busters Slot Preview by Play’n GO

US Gambling Tax Shift May Force Erik Seidel to Reduce Poker Schedule

US Gambling Tax Shift May Force Erik Seidel to Reduce Poker Schedule

Play’n GO Released Tome of Madness

Play’n GO Released Tome of Madness