The Online-Casinos.com News in 2025

Welcome to the news hub of Online-Casinos.com. Here we cover all the latest developments concerning online gambling. Our news team will bring you current updates about legislation, casinos, sports, poker, as well as expert analysis and fun trivia from across the gambling industry.

Free spins rounds, a Golden Torpedo Builder and xBombs are among the great slot features included in the new slot release Das xBoot 2, which is being released at UK online casinos from Nolimit City on December 16. Das xBoot 2 in Brief: Release Date: 16 December 2025 Type: Video...

High-stakes poker pro Mario Mosböck has entered the crowded but potentially lucrative YouTube/Poker marketplace. Key...

World Eaters is a rather quirky new online slot from ELK Studios, themed to huge...

Featuring 64 first-round matches, the 2026 World Darts Championship offers an abundance of betting opportunities....

Gambling charities in the UK have aired concerns over how they will be funded after...

BGaming’s new slot UFO Pyramids releases on 16 December 2025. Set in one of the...

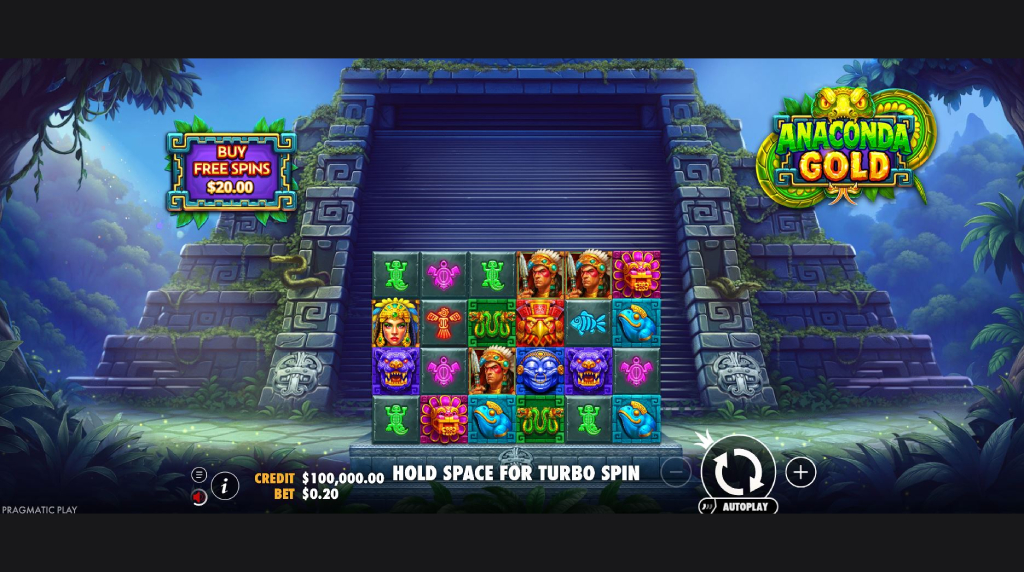

Traverse a temple full of giant symbols in Anaconda Gold by Pragmatic Play. Releasing on...

Light & Wonder’s new Huff N’ Xtra Puff online slot arrives on 11 December 2025....

Gibraltar minister expresses concerns about UK gambling tax rises and the potential effects on Gibraltar....

Hammerstorm from Pragmatic Play, releasing on 11 December 2025, is a high volatility 5×3 Viking...

Fortune of Olympus draws inspiration from the rich mythology of ancient Greece and has Zeus,...

All My Gold is a new Hold and Win slot game from ReelPlay, with UK...

The gang returns for another heist with Iron Bank 2 by Relax Gaming. Releasing on...

Nolimit City Preparing Das xBoot 2 for UK Slots Sites

Nolimit City Preparing Das xBoot 2 for UK Slots Sites

Top Pro Mario Mosböck Launches a New Poker Channel on YouTube

Top Pro Mario Mosböck Launches a New Poker Channel on YouTube

Check Out ELK Studios’ New World Eaters Slot on 18 December

Check Out ELK Studios’ New World Eaters Slot on 18 December

World Darts Championship First Round Bankers and Best Bets

World Darts Championship First Round Bankers and Best Bets

Gambling Levy Funding Gap Fears for UK Charities

Gambling Levy Funding Gap Fears for UK Charities

BGaming Releases UFO Pyramids on 16/12/2025

BGaming Releases UFO Pyramids on 16/12/2025

Pragmatic Play is Releasing Anaconda Gold on the 18th of December.

Pragmatic Play is Releasing Anaconda Gold on the 18th of December.

Huff N’ Xtra Puff by Light & Wonder – New Online Slot Preview

Huff N’ Xtra Puff by Light & Wonder – New Online Slot Preview

Warnings About Tax Rise Consequences on Gibraltar Gambling

Warnings About Tax Rise Consequences on Gibraltar Gambling

Hammerstorm Slot Review – Lightning Respins Up to 10,000x

Hammerstorm Slot Review – Lightning Respins Up to 10,000x

Spin the Reels of Pragmatic Play’s New Fortune of Olympus Slot on 15 December

Spin the Reels of Pragmatic Play’s New Fortune of Olympus Slot on 15 December

ReelPlay Releasing All My Gold Slot on December 16

ReelPlay Releasing All My Gold Slot on December 16

Relax Gaming is Releasing Iron Bank 2 on the 10th of December

Relax Gaming is Releasing Iron Bank 2 on the 10th of December